Introduction: Why Budgeting in Your 20s is a Superpower

Your 20s are wild. New jobs, new cities, side hustles, student loans, peer pressure to spend, and the tempting belief that “I’ll save later.” But here’s the truth: If you can master your money in your 20s, you set yourself up for financial freedom in your 30s, 40s, and beyond.

That’s where these smart budgeting tips for young adults come in. Whether you’re earning a little or a lot, budgeting isn’t about restriction—it’s about direction. It’s about spending with purpose so you can live life on your terms.

Let’s break down exactly how you can build a smart, realistic budget—and actually stick to it.

1. Know Where Your Money’s Going (Awareness is Key)

Before you budget, track. You can’t improve what you don’t measure.

✅ Action Steps:

- Use apps like Mint, YNAB (You Need A Budget), or Spendee to track every rupee or dollar you spend.

- Categorize your spending: rent, food, subscriptions, travel, fun.

- Do this for at least 30 days. You’ll be shocked by how much goes to coffee or food delivery.

Pro Tip: Tracking your spending is the wake-up call most young adults need before building a budget.

2. Choose the Right Budgeting Method for You

Not every method works for everyone. Find the one that matches your mindset.

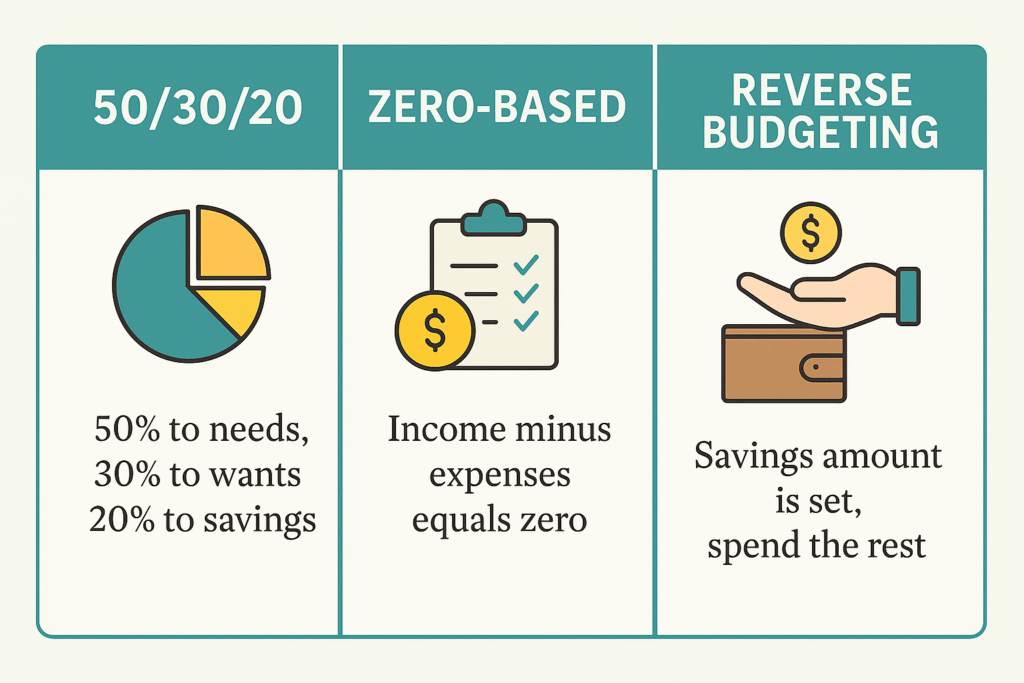

🧠 Popular Budgeting Systems:

- 50/30/20 Rule: 50% needs, 30% wants, 20% savings/debt.

- Zero-Based Budget: Every dollar is assigned a job—even if that job is fun money.

- Reverse Budgeting: Pay yourself first (investments, savings), then spend what’s left.

💡 One of the smartest budgeting tips for young adults is to experiment with 1–2 methods and see which one you can stick to consistently.

3. Build an Emergency Fund (Even If It’s Just ₹1000/$100 a Month)

Life happens. Flat tires, surprise bills, job loss. Having a small buffer makes the difference between stress and security.

💸 How to Start:

- Open a separate savings account.

- Automate ₹500–1000/month or $10–$50/week.

- Don’t touch it unless it’s truly an emergency.

Having even ₹10,000 or $200 set aside can prevent debt spirals. This is adulting 101.

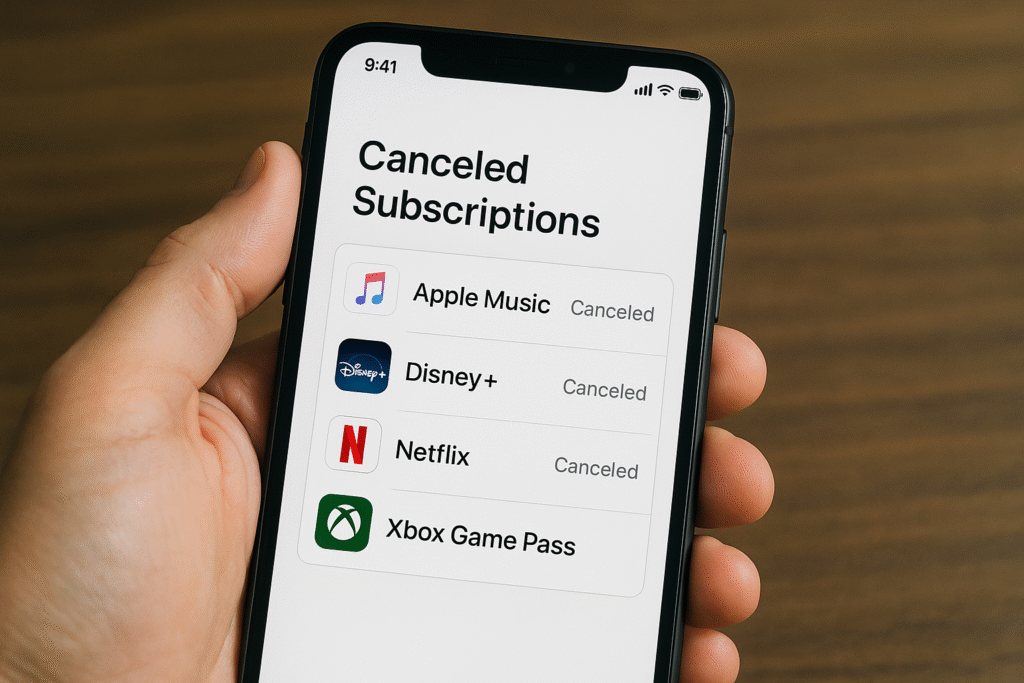

4. Cancel Sneaky Subscriptions

You’re probably paying for things you forgot. It’s eating your budget silently.

🚫 Cut the Fat:

- Use apps like Truebill or CRED to scan subscriptions.

- Cancel duplicate services (do you need Netflix and Prime and Disney+?).

- Set calendar reminders before trials renew.

This is one of the quickest budgeting tips for young adults that brings instant results.

5. Budget for Fun (Seriously)

If your budget feels like punishment, you won’t stick to it.

🍕 Plan Guilt-Free Spending:

- Create a “fun money” category (₹2000/month or $50/week).

- Use it for dining out, dates, concerts, etc.

- Spend it fully—and guilt-free.

This keeps your budget sustainable without making you feel deprived.

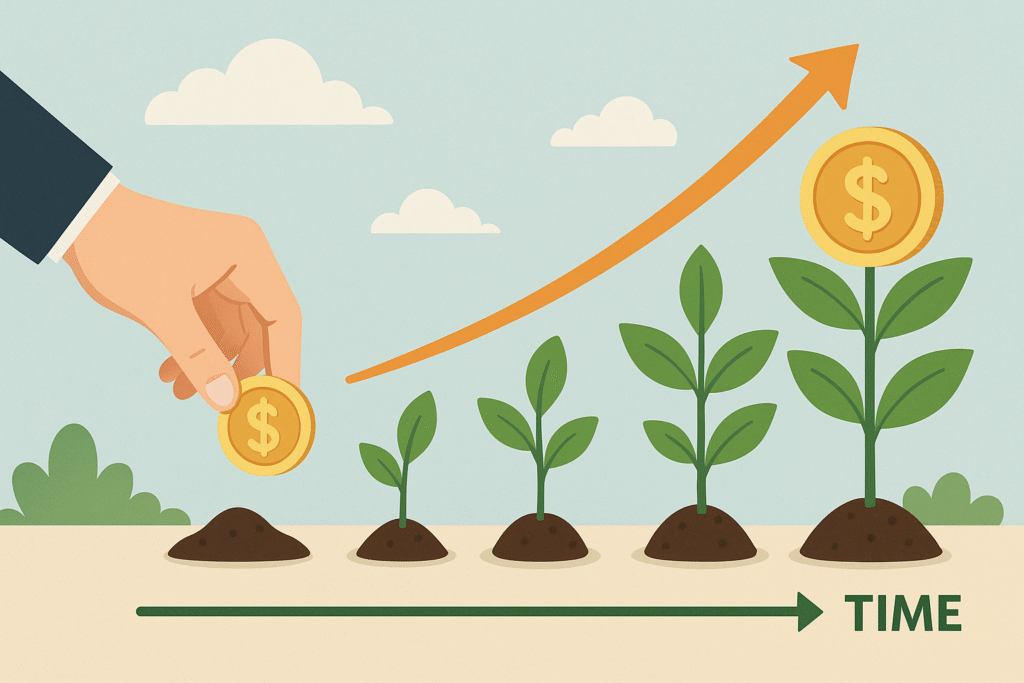

6. Start Investing Early (Even with ₹500 or $10 a Week)

You don’t need a big income to start building wealth. Just start.

📈 Easy Ways to Begin:

- Use platforms like Zerodha, Groww (India) or Robinhood, Acorns (US).

- Start with ETFs or index funds.

- Automate weekly contributions, however small.

The earlier you invest, the more time your money has to grow. Compound interest is your superpower.

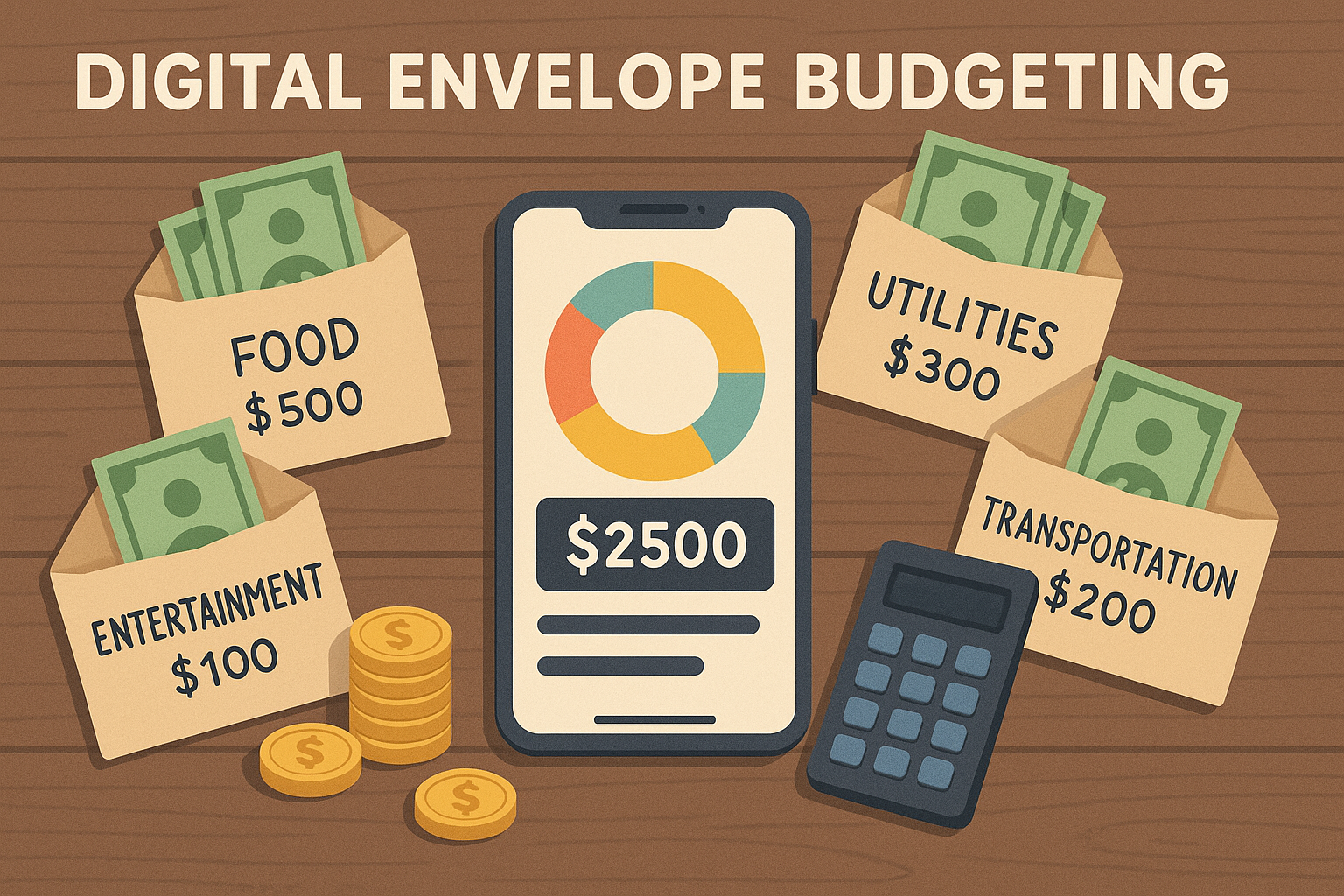

7. Use the Envelope Method (Digitally)

Old-school budgeting still works—but smarter.

💼 Try This:

- Create separate digital envelopes using banking apps.

- Allocate money weekly: groceries, entertainment, bills, etc.

- When one envelope’s empty, stop spending in that category.

This visual method helps build spending discipline and clarity.

8. Plan Monthly Financial Reviews

Check in with your money like you check your phone. Consistently.

🧾 How to Review:

- Look at your expenses, savings, and debts.

- Ask: What worked? What overspent? What can be improved?

- Adjust your categories and goals monthly.

One of the most overlooked budgeting tips for young adults is reflection. A monthly check-in makes you more accountable. (connect habits and discipline with budgeting).

9. Prioritize High-Interest Debt

If you’re carrying credit card debt or high-interest loans—focus on killing them.

🔥 Two Proven Methods:

- Snowball Method: Pay off smallest debt first for momentum.

- Avalanche Method: Pay off highest interest rate first to save money.

Use tools like Debt Payoff Planners or Excel to track your progress.

10. Create a “Side Hustle Fund”

Your budget should help you grow—not just survive.

🛠️ Use a Side Hustle to:

- Fund your hobbies (e.g. photography, content creation).

- Start freelancing or part-time gigs.

- Reinvest in learning new skills.

Add a line in your budget that invests in future you. “7 Best Side Hustles to Earn Extra Income in 2025.”

Real-World Example: How I Budgeted My Way Out of Chaos

When I first got a job, I spent recklessly—new clothes, food delivery every day, subscriptions I never used. My bank balance barely made it to the 15th.

Here’s what changed:

- I tracked every expense for 30 days.

- Used the 50/30/20 rule and stuck to it.

- Cancelled 5 unused subscriptions.

- Set up automatic SIPs (investments).

- Within 6 months, I had ₹20,000 saved, started investing ₹2000/month, and felt in control.

This isn’t luck—it’s consistent action. You can do it too.

Final Thoughts: You Don’t Need to Be Rich to Budget—You Budget to Get Rich

Budgeting isn’t about cutting back on lattes. It’s about gaining control, peace of mind, and direction. These budgeting tips for young adults aren’t about restriction—they’re about creating a life of freedom, growth, and financial confidence.

Start small. Be consistent. And remember: your 20s are not too early—it’s the perfect time to build your wealthy future.

1. What is the best budgeting method for young adults?

The 50/30/20 rule is a simple and effective method to start with. It balances needs, wants, and savings effectively.

2. How can I budget with a low income?

Focus on tracking your spending, cutting unnecessary expenses, and building small savings habits like automating ₹500 or $10/month.

3. Is investing important in your 20s?

Yes! Starting early gives your money more time to grow through compound interest—even small amounts make a big difference.

4. Should I pay off debt before saving?

Do both. Build a small emergency fund, then aggressively attack high-interest debt using the avalanche or snowball method.

5. How do I stay consistent with budgeting?

Schedule monthly reviews, use budgeting apps, and make space for fun spending so you don’t feel restricted.

Leave a Comment