Introduction

Have you ever wondered why some people seem to manage their money effortlessly while others struggle to make it through the month? The secret isn’t in how much they earn—it’s in how they budget. Unfortunately, most schools don’t teach personal budgeting strategies, leaving many to figure it out the hard way. In this guide, you’ll discover a simple yet powerful budgeting formula that will help you take control of your finances and go from broke to ballin’.

- “For a comprehensive step-by-step guide on budgeting, you can refer to NerdWallet’s article on How to Budget Money.”nerdwallet.com

Table of Contents

Why Budgeting Matters More Than You Think

If you’ve ever thought, “I don’t need a budget,” think again. A solid personal budgeting strategy can:

- Prevent you from living paycheck to paycheck

- Help you save for your future

- Reduce financial stress and anxiety

- Keep you prepared for emergencies

Budgeting isn’t about restrictions—it’s about financial freedom. With the right personal budgeting strategies, you can decide where your money goes rather than wondering where it went.

The Budgeting Formula No One Taught You

Most people follow the 50/30/20 rule, which means:

- 50% of income for necessities (rent, bills, groceries)

- 30% for wants (entertainment, shopping, dining out)

- 20% for savings and debt repayment

This method is a great start, but there’s an even better way to build long-term financial success.

For a deeper dive into foundational budgeting techniques, especially tailored for younger audiences, check out our article on 5 Budgeting Tips for Teens: How to Save and Spend Wisely.

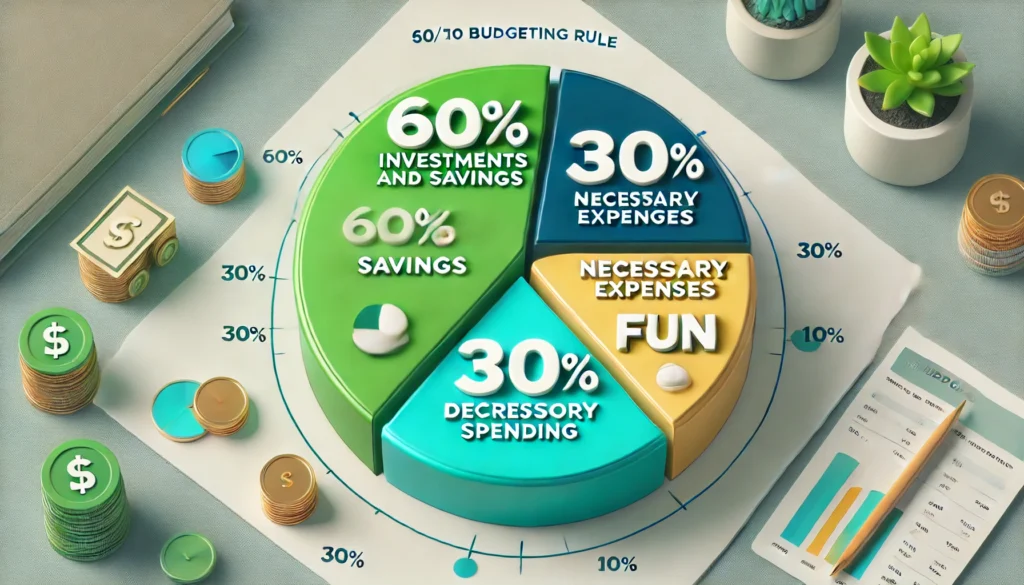

The “60/30/10 Rule” – A Smarter Budgeting Strategy

For a more effective personal budgeting strategy, consider this 60/30/10 formula:

- 60% – Wealth Building & Future Investments

- This includes savings, investments, retirement funds, and paying off debt. The goal is to build assets that grow over time.

- 30% – Necessary Expenses

- Rent, utilities, groceries, transportation—these are must-pay expenses. Keeping this portion as low as possible allows you to maximize your savings.

- 10% – Fun & Flexibility

- This is your guilt-free spending category—dining out, hobbies, shopping, or anything you enjoy.

This strategy flips the traditional approach by prioritizing wealth-building first, ensuring financial stability and growth.

How to Implement Personal Budgeting Strategies Successfully

1. Track Every Rupee You Spend

You can’t fix what you don’t measure. Start tracking your expenses using apps like Mint, YNAB, or a simple Google Sheet. Identify where your money is going and adjust your spending habits accordingly.

2. Automate Your Savings

Make saving money effortless by setting up automatic transfers to your savings and investment accounts. Treat it like a non-negotiable bill—before you spend on anything else, pay yourself first.

3. Reduce Unnecessary Expenses

Are you spending too much on subscriptions, impulse shopping, or takeout food? Cutting back on unnecessary expenses can free up money for investments and savings.

4. Use the “Cash-Only” Method for Discretionary Spending

Withdrawing a set amount of cash for fun spending each week can prevent you from overspending on things that don’t align with your goals.

5. Set SMART Financial Goals

Instead of vague goals like “I want to save money,” use SMART goals:

- Specific: “Save ₹50,000 for an emergency fund.”

- Measurable: Track progress each month.

- Achievable: Ensure it’s realistic based on your income.

- Relevant: Align with your financial future.

- Time-bound: Set a deadline to stay accountable.

6. Plan for Unexpected Expenses

Life happens—unexpected medical bills, car repairs, or job losses. That’s why an emergency fund should be a non-negotiable part of your personal budgeting strategies.

To explore how artificial intelligence is revolutionizing personal finance management, read our article on 10 Revolutionary Ways AI in Personal Finance is Transforming Money Management.

The Psychology Behind Budgeting: Why Most People Fail

Understanding money psychology can help you stick to your budget. Many people fail at budgeting because:

- They see it as restrictive rather than empowering.

- They don’t have clear financial goals.

- They lack the discipline to track spending.

- They get discouraged by setbacks and give up too soon.

By adopting a growth mindset and making budgeting a habit, you can create lasting financial success.

Final Thoughts: Make Budgeting a Lifestyle, Not a Chore

Mastering personal budgeting strategies isn’t about perfection—it’s about consistency. Start small, make gradual improvements, and adjust as needed. Whether you use the 50/30/20 rule or the 60/30/10 formula, the key is to be intentional with your money.

So, are you ready to take control of your finances and go from broke to ballin’? The best time to start budgeting was yesterday. The second-best time is now.

Take action today and set yourself up for financial success!

FAQs: Your Budgeting Questions Answered

1. How do I start budgeting if I’ve never done it before?

Starting is simple! Begin by tracking all your income and expenses for a month. Then, choose a budgeting method like the 50/30/20 rule or the 60/30/10 formula to allocate your money efficiently. Use budgeting apps or a simple spreadsheet to stay organized.

2. What’s the best budgeting strategy for someone with irregular income?

If your income fluctuates, use the baseline budgeting method—set your budget based on your lowest monthly earnings and adjust savings and discretionary spending when you earn more. Prioritize an emergency fund to cover low-income months.

3. How can I stick to my budget without feeling restricted?

Budgeting isn’t about deprivation; it’s about intentional spending. Always include a category for fun (even if it’s small) so you don’t feel like you’re missing out. Also, review your budget monthly and make adjustments to keep it realistic.

4. Should I pay off debt first or save money?

If your debt has a high-interest rate (above 10%), prioritize paying it off while saving a small emergency fund. If your debt has a lower interest rate, balance both debt repayment and saving to build long-term financial security.

5. How often should I review and adjust my budget?

At least once a month! Regular budget check-ins help you stay on track, spot unnecessary spending, and make necessary adjustments as your financial situation changes.

Leave a Comment