Introduction: Why Every Teen Needs a Budget in 2025

If you’re a teenager in 2025, you’re growing up in a world of online spending, side hustles, and constant financial FOMO. One minute you’re earning from freelancing or helping out at home, and the next you’re spending it all on delivery apps, streaming subscriptions, or that one pair of sneakers you saw on Instagram.

Let me tell you something real: money doesn’t disappear. We just give it away carelessly when we don’t have a plan.

That’s where a teen budget comes in. It isn’t about restrictions. It’s about freedom. Freedom to buy what you love without guilt. Freedom to save for your goals without stress. Freedom to say no to things that don’t matter because you know what does.

And if no one taught you this in school? Don’t worry. You’re about to learn it now—from someone who learned the hard way.

New to managing money? Start with our Beginner Personal Finance Guide.

Table of Contents

Step 1: Know Your Why

Before numbers, apps, or charts—start with your emotions.

Ask yourself: Why do I want to manage my money better?

- To save for a phone or laptop?

- To stop feeling broke by the end of every month?

- To help your family or start investing early?

A teen budget only works when it’s tied to something personal. Not your teacher’s advice. Not a random article. Your reason.

Write it down. That’s your anchor.

“When the why is clear, the how becomes easier.”

Step 2: Track Where Every Rupee Goes

You can’t fix what you don’t see.

For one full week, track everything:

- Money received (pocket money, gifts, side gigs)

- Money spent (food, transport, subscriptions, random buys)

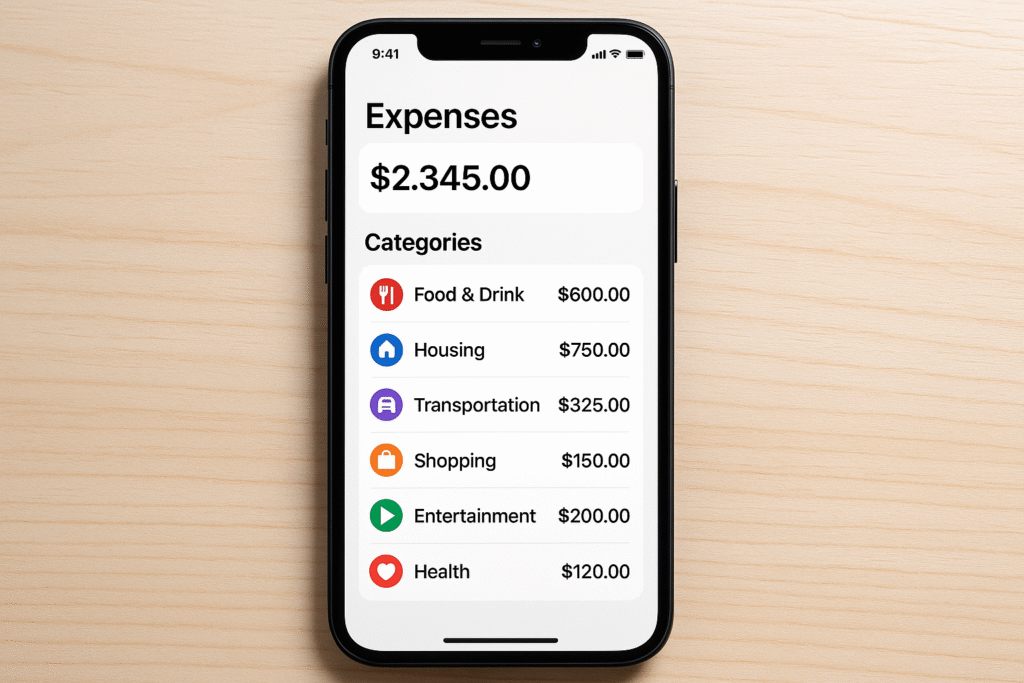

Use apps like:

- Walnut (India)

- Money Manager (Android/iOS)

- Or a simple Google Sheet

You’ll be shocked how much leaks out in snacks, UPI payments, or casual online spending.

This is the moment most teens realize they don’t have an income problem—they have a leaking bucket.

Want to avoid the most common budgeting traps? Check out Top 7 Money Mistakes Teens Make

Step 3: Build Your First Teen Budget with the 50/30/20 Rule

Now let’s create a real, working teen budget that fits YOUR life.

Here’s the simplest rule that even millionaires follow:

- 50% Needs (food, transport, school stuff)

- 30% Wants (entertainment, fashion, subscriptions)

- 20% Savings (future goals, investing, emergency fund)

Example: Let’s say you earn/receive ₹2,000 monthly:

- ₹1,000 goes to needs

- ₹600 goes to wants

- ₹400 goes to savings

Even if you start with ₹500, the habit matters more than the amount.

This is how you train your brain to stop reacting to money and start leading it.

Step 4: Use Visuals & Automation

Make your budget visible. Create a chart or use a notebook where you write:

- What you spent

- What you saved

- How close you are to your goal

Want to go pro? Automate it:

- Open a separate savings account (many banks offer teen-friendly accounts)

- Auto-transfer money every time you get paid

Out of sight = out of mind = safe savings.

Financial success isn’t just about logic. It’s about creating an emotional system that protects your future self.

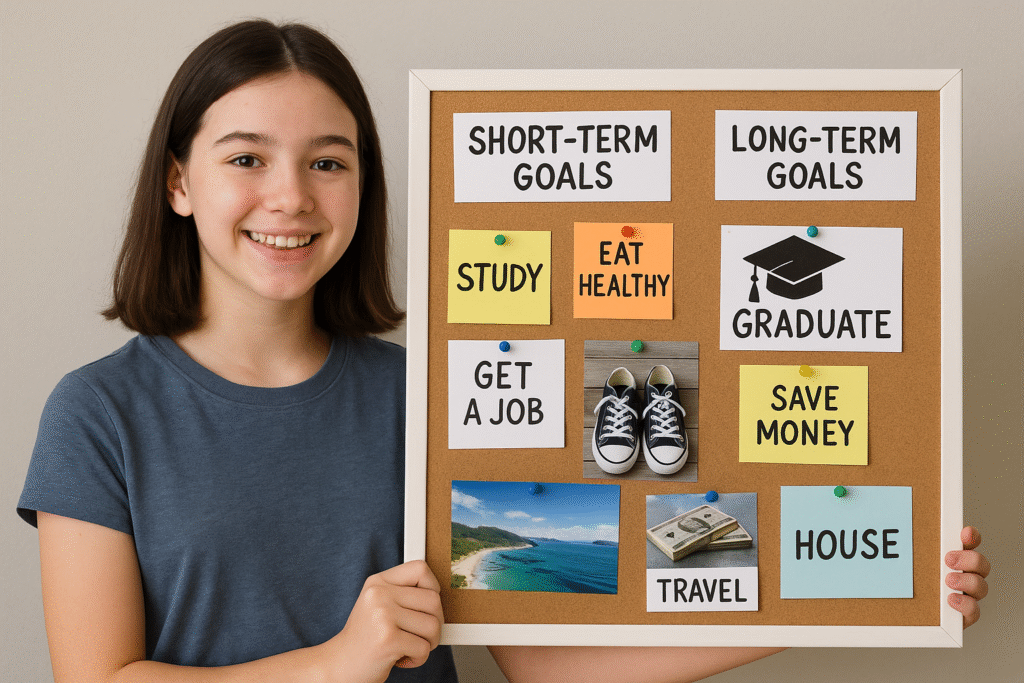

Step 5: Set Realistic Goals That Excite You

No, don’t aim to save ₹1 lakh in 3 months. That’s not inspiring—that’s overwhelming.

Start with:

- Short-Term: A new phone, gaming gear, books

- Mid-Term: A solo trip, investing in a course

- Long-Term: Laptop, emergency fund, business idea

Tie your teen budget to your goals, and it becomes a lifestyle, not a chore.

Every rupee saved with purpose has 10x more power than a rupee spent on impulse.

Step 6: Learn to Say “No” (With Confidence)

This might hurt—but it’s necessary.

- Say no to trends that drain your wallet.

- Say no to friends who don’t respect your goals.

- Say no to buying something just because everyone else has it.

This is where real emotional strength builds.

Because budgeting isn’t just about math. It’s about identity.

Who do you want to be? A teen who follows others or a teen who builds freedom?

Step 7: Review Weekly, Adjust Monthly

Budgeting is a living skill. You’ll get better with time.

Every Sunday:

- Review your spending

- Track how much you saved

- Adjust next week’s budget based on what worked

Every Month:

- Increase your savings rate by 5%

- Cut out 1 unnecessary expense

- Celebrate 1 small win

Remember: A teen budget isn’t a punishment. It’s a permission slip for smarter choices.

Final Thoughts: A Budget Is Not About Money. It’s About Power.

By learning how to build a teen budget that works, you’re doing something most adults struggle with.

You’re claiming control. You’re building clarity. You’re choosing progress over pressure.

And years from now, when others are panicking over debt, confusion, and paycheck-to-paycheck living—you’ll be thriving.

Because you chose to lead your money. Not follow it.

Your budget is not just numbers on a page. It’s the story of your future.

FAQ’S

Q1. What is a teen budget and why is it important?

A: A teen budget helps young people manage their income, control spending, and start saving early. It teaches real-life money skills and builds discipline for adulthood.

Q2. What’s the easiest way to create a budget as a teen?

A: Use the 50/30/20 rule to divide your income into needs, wants, and savings. Start by tracking your expenses and setting small savings goals.

Q3. Can I budget without a steady income?

A: Yes! Budgeting isn’t about how much you earn but how you manage it. Even small weekly allowances or gift money can be organized smartly.

Q4. Which apps are best for teen budgeting in 2025?

A: Walnut and Money Manager are great free apps. You can also use simple Google Sheets to track your spending manually.

Q5. How do I stay motivated to stick to a budget?

A: Set exciting goals, review your budget weekly, and remind yourself of your “why.” Visualizing progress helps build motivation.

Scrollable

Leave a Comment